Author: foggedin

20 Apr Unemployment Highlights In a Time of Coronavirus: Updated 04.20.2020

Unemployment claims are rocketing up in numbers and it is new territory for some employers.

We will continue to update the latest information regarding unemployment during the Covid-19 pandemic here in this blog post. Changes to unemployment nationally that you should be aware of:03 Apr PPP Loans: Paycheck Protection Program Loan Resources and Information

The small business economy of the United States is impatiently waiting while the SBA and U.S. Treasury are trying to figure out what the CARES Act means. The most popular segment of the benefits package is the Paycheck Protection Program Loan. With its forgiveness that acts as a grant, many small businesses view this as a much-needed life preserver. Referred to as PPP Loans, these loans will be distributed by Small Business Administration (SBA) lenders. Right now, those lenders are also still trying to figure out the details. So what do you need to know about PPP Loans?02 Apr CARES Act COVID-19 Relief Options: How Do The Programs Stack Up?

The Families First Relief Act and CARES Act have been approved and businesses, like yours, are scrambling to figure out what it all means. The information is coming fast and furious so it can be hard to make sense of what is right for your business. Below is a current assessment of the landscape as compiled by Ascend Consulting, Fogged In Bookkeeping, and Prix Fixe Accounting. This should not be taken as individual tax advice but rather as a guide. Always consult with your individual tax advisor to see how such programs may apply to your individual situation.01 Apr Paycheck Protection Loans: SBA Relief Option 1

The much-awaited Cares Act passed last week. Included in the act were SBA relief loans like the Paycheck Protection loans. Immediately small business owners began the quest for "free money". We have compiled a list of resources below to help business owners with this process. The list will update these as things evolve; which they seem to do each day. Also, a word of caution, many owners see the Paycheck Protection Loan program as the magic bullet, and it isn't always the best solution for every case. There are SEVERAL other relief offerings under the CARE Act and each has unique benefits.26 Mar SBA Express Bridge Loans up to $25k Now Available

Just in from the Nantucket Chamber of Commerce: In response to the COVID-19 National Emergency, the SBA Express Bridge Loan (EBL) Pilot Program has been modified and the term extended. The EBL Pilot Program is designed to supplement the Agency’s direct disaster loan capabilities and authorizes SBA Express Lenders to provide expedited SBA-guaranteed bridge loan financing on an emergency basis in amounts up to $25,000 for disaster-related purposes to small businesses located in communities affected by Presidentially-declared disasters while those small businesses apply for and await long-term financing (including through SBA’s direct Economic Injury Disaster Loan Program, if eligible).17 Mar Now What? Business Ops Guide for Restaurants FREE WEBINAR

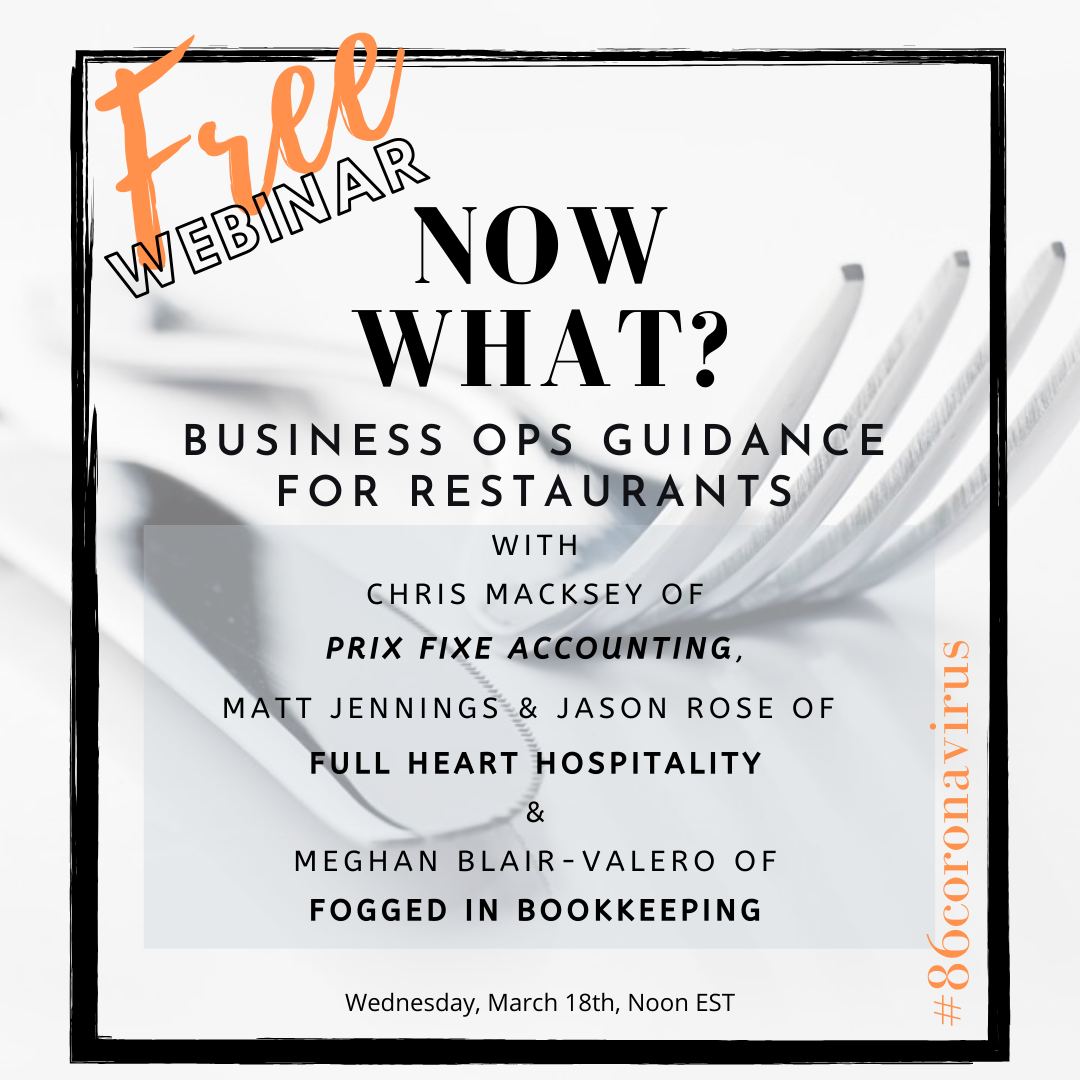

The world has changed overnight. Now what? Chris Macksey of Prix Fixe Accounting, Matt Jennings and Jason Rose of Full Heart Hospitality, and Meghan Blair-Valero of Fogged In Bookkeeping are bringing the clutch wisdom on cashflow, laying off employees, insurance, relief funds, things to consider...

12 Mar Coronavirus Update from Fogged In Bookkeeping

Our Fogged In team wanted to give you an update as the Coronavirus pandemic spreads and begins to have impacts big and small on our daily lives and businesses. As we proceed without panic, but with an abundance of caution, our team may make some small, and temporary, changes in our operations. These changes will have very minimal impacts as we are already a virtual firm.Fogged In Bookkeeping Operations

Fogged in Bookkeeping Operations in the day-to-day accounting work will remain unchanged. Except for Lucretia here in our Nantucket office, the team works remotely from their homes. Our systems are cloud-based and are set up for fully remote work. Below are our everyday recommendations that become even more important now.07 Mar Awards: Hubdoc Top 50 Cloud Accountants AND Practice Ignition Top 50 Women In Accounting

2019 has been an exciting year for us here at Fogged In Bookkeeping winning two awards and it is only March. Early in the year Fogged in was acknowledged as one of Hubdoc's "Top 50 Cloud Accountants in North America" and just tonight we have...

27 Sep Cash Controls: Preventing Theft One Step At A Time

Cash controls in a business start before you ever take a dollar; they begin in the systems you set up...