20 Apr Unemployment Highlights In a Time of Coronavirus: Updated 04.20.2020

Unemployment claims are rocketing up in numbers and it is new territory for some employers.

We will continue to update the latest information regarding unemployment during the Covid-19 pandemic here in this blog post.

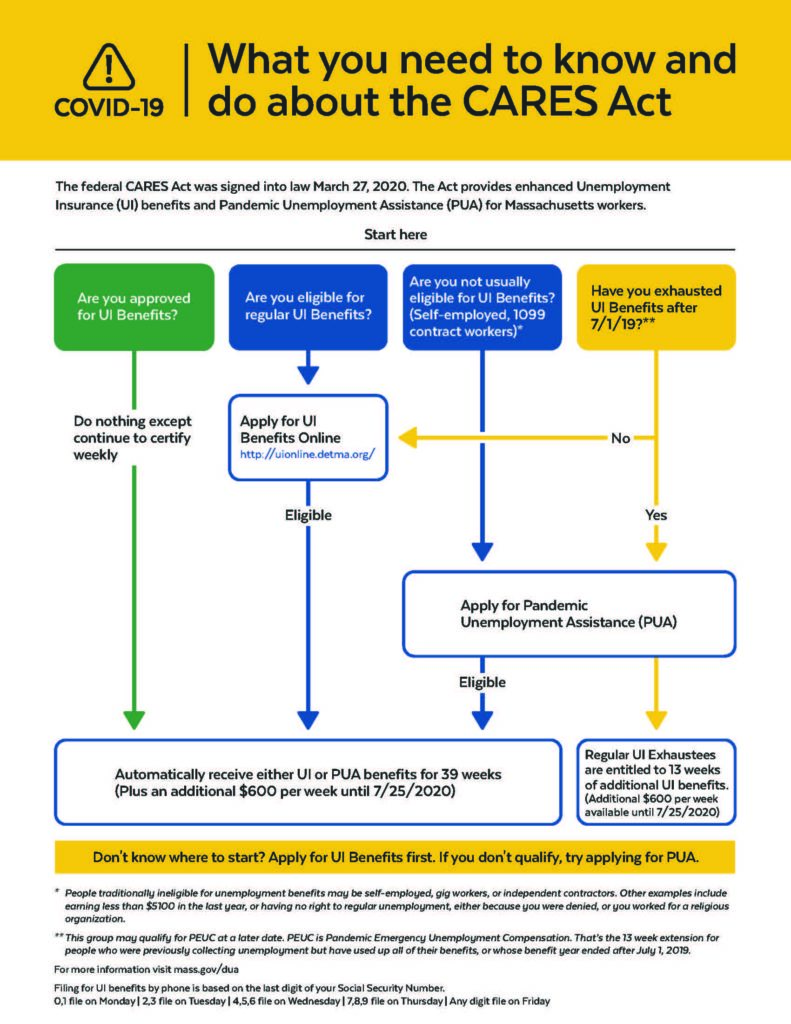

Changes to unemployment nationally that you should be aware of:

-

- Unemployment extended to 39 weeks

- $600/week boost to benefits

- Gig workers and contractors QUALIFY for unemployment and should apply for PUA benefits.

- Employees that are furloughed but not laid off can continue to get benefits from their employer and UI benefits.

- Check for sick pay benefits first to extend the UI benefit.

A helpful article from FORBES can be found HERE

Quick links:

Getting Lots of Claim Surveys? Best Practices for Layoffs and Responding to Your DUA Notices

Laying off employees often means a TON of paperwork. Here is a list of things to be on the lookout for and best practices for employers

- Check your Department of Unemployment employer portal frequently. We are noticing an uptick in missed emails etc and you want to stay on top of these claims to get your people their benefits faster.

- If you receive a claim survey asking for last year’s wage data something is probably wrong. The state should have wage data for all employees for prior quarters and automatically pulls that information. You should not have to enter it again. If the DUA is asking for that data again check the following:

- Is the employee your employee and are they entitled to a claim

- Is their social security number on the claim correct? If their number is correct on the claim but wrong in your system fill out the info request and correct in your system. If you have the correct information and the employee filed with the wrong number ask them to fix their claim.

- Is their name the same as you have it in your payroll system. Look out for James filing as Jim etc.

- Did they file for periods they were not on your payroll? If they filed a claim and said the work dates were 1/1/19 to current and they didn’t work for you back then more likely than not it’s just a typo on their part. These forms are confusing. Just fill in all zeros on the questionnaire.

- Did you file and pay your quarterly DUA tax filings? If you didn’t NOW IS THE TIME. Make sure your filings are complete. If need be you can set up a payment plan for the payments.

- Give your employees the correct forms when you lay them off. Each state is different but in Massachusetts, you are required to provide a form 590 that provides guidance to the employee on how to claim. It has a space to put your business name, EIN, and other important information. This will help your people access benefits as quickly as possible and avoid delays due to mismatched information.

MA Health Connector has extended the open enrollment period to April 25th

https://mahealthconnector.optum.com/individual/ to complete an enrollment application

What if I was unemployed BEFORE coronavirus due to seasonal employment or other reasons?

From the MA DUA website:

“I was already receiving benefits when the COVID-19 crisis hit. What will happen when I hit 26 weeks?

Unfortunately, under current law 26 weeks is the maximum amount of benefits to which you’re entitled. Once you reach that limit you are not entitled to more weeks, even if you began your claim before the current crisis. “

As of an hour or so ago (March 27, 2020) the House passed the stimulus bill so the federal aid will likely change the above rules but employees will have to reapply for additional benefits. According to Jennifer Liu and her CNBC article:

“Individuals who are newly eligible under the stimulus bill and have been unemployed since the week of January 27, 2020, will be able to receive the additional $600 weekly benefit and 13-week period extension.

Those who are already receiving unemployment assistance can also apply for an extension. Unemployed individuals currently coming to the end of their benefits period can reapply for additional coverage and receive the $600 additional payment and a 13-week extension.”

Unemployment for Massachusetts contractors and 1099 workers

“Pandemic Unemployment Assistance (PUA) provides up to 39 weeks of unemployment benefits to individuals who are unable to work because of a COVID-19-related reason but are not eligible for regular or extended unemployment benefits.”

What you need for Apply for Pandemic Unemployment Assistance

Pandemic Unemployment Assistance (PUA) provides payment to workers not traditionally eligible for unemployment benefits (self-employed, independent contractors, workers with limited work history, and others) who are unable to work as a direct result of the coronavirus public health emergency.

Applicants will need to provide the following information:

Your social security number

If you are not a citizen of the United States, your A Number (USCIS Number)

Your residential address

Your mailing address (if different from residential address)

Your telephone number

Your email address

Your birth date

Your wage records for 2019, which includes:1099 forms

Pay stubs

Bank statements

The social security number(s) and date(s) of birth for your dependent child(ren)

If you want to use direct deposit for payment, your bank account and routing numbers

No Comments